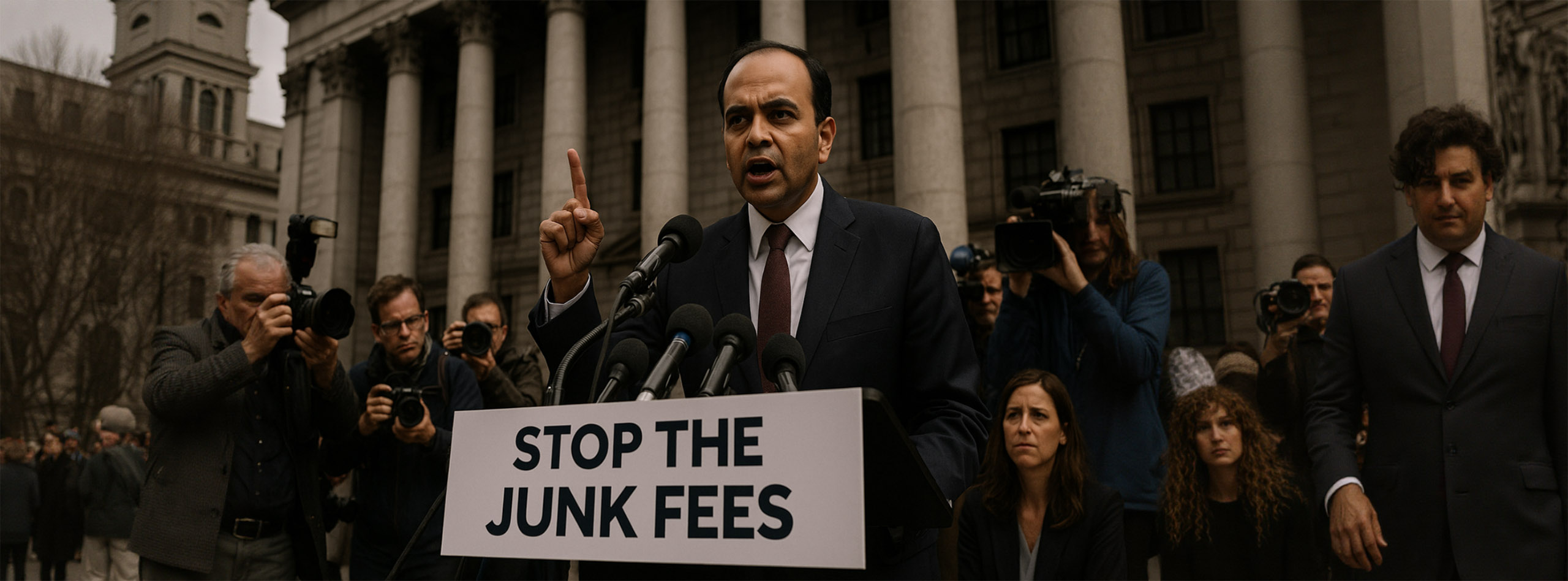

New Rule Caps “Junk Fee” and Sparks Industry Pushback

The Consumer Financial Protection Bureau finalized a rule in early 2024 to drastically cut credit card late fees – from typical levels around $30 down to an $8 safe-harbor cap for large card issuers. CFPB Director Rohit Chopra declared that “today’s rule ends the era of big credit card companies…hiding behind the excuse of inflation” to hike punitive fees. The rule, part of a broader crackdown on so-called “junk fees,” eliminates automatic inflation increases and requires issuers to justify any higher fee by actual costs.

Collections managers at credit unions took note: lower late fees could reduce borrowers’ deterrence to pay on time and shrink fee income. The credit union industry voiced concerns that the $8 cap might not cover collection costs, especially as smaller issuers were largely exempt but large credit unions were included. By year’s end, trade groups and banks challenged the rule in court – setting the stage for a legal battle over how far regulators can go in dictating fee strategies.

Takeaway: The late-fee cap signals regulators’ aggressive stance on consumer costs, forcing collections teams to adjust strategies without heavy reliance on penalty fees.