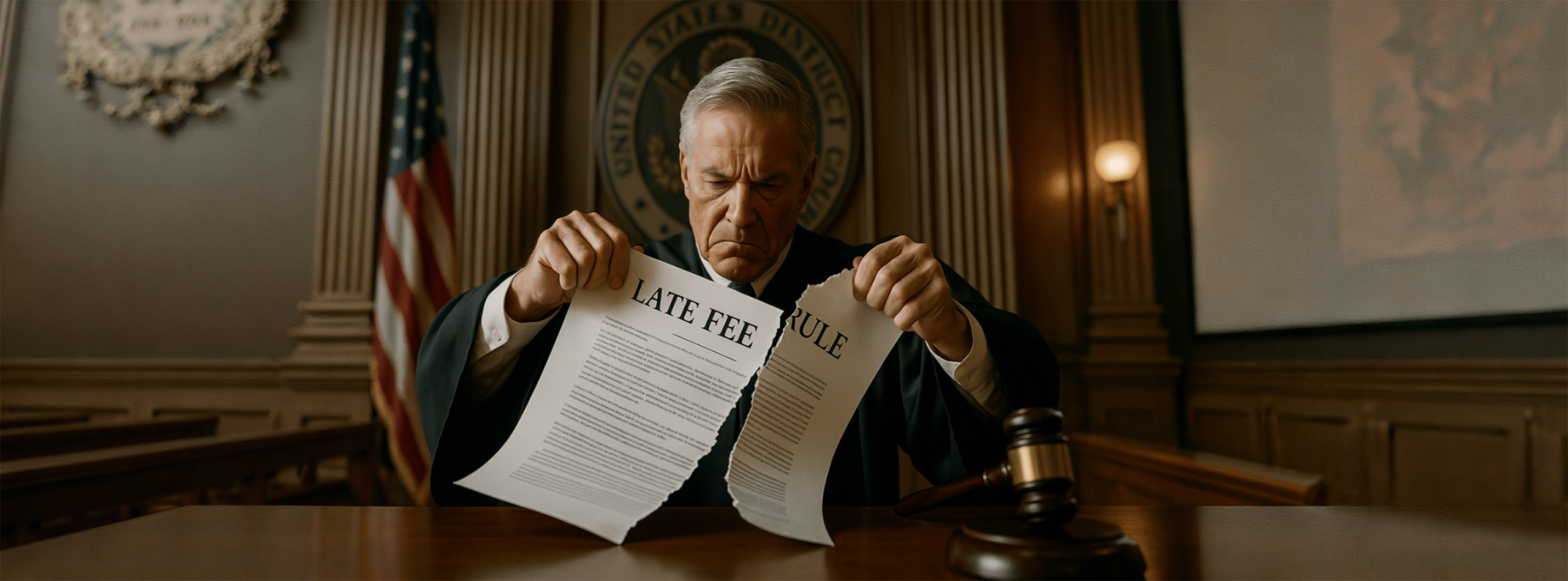

Industry Lawsuit and New Leadership Prompt Rule’s Demise

The drama over credit card late fees took a new turn in 2025. A federal judge threw out the CFPB’s $8 late fee cap rule in April 2025, just weeks before it was set to take effect. In a surprising twist, the CFPB itself – now under new leadership following the 2024 election – agreed with industry challengers that the Biden-era rule was legally flawed.

The court’s decision vacated the rule entirely, citing that it conflicted with the Credit CARD Act’s requirement that penalty fees be “reasonable and proportional” to the violation. Banking and credit union trade groups hailed the reversal, having argued the $8 limit was arbitrary and would force costs onto responsible borrowers.

For credit unions, this means the pre-2024 fee framework remains in place – higher late fees (often $25–$30 for first offenses) are still allowed if justified by costs.

Collections managers breathed a sigh of relief that an important deterrent for late payments was restored. However, the episode isn’t without lasting impact. The initial rule and its rollback consumed resources and created operational whiplash: many institutions had prepped to comply with the $8 cap. It also reinforced the sense that regulatory swings can be sudden.

Takeaway: The late fee saga underscores how politics and courts can swiftly alter compliance requirements. Collections teams should stay agile – what’s prohibited one year may be permitted the next – and focus on member communication and flexibility in assessing fees, rather than relying on maximum penalties.