Fintech Partnerships Help CUs Meet Members on Their Phones

In 2024, credit unions doubled down on digital communication to reach delinquent members, adopting modern collections platforms at a record pace. One standout example: AKUVO’s collections platform added 55 new financial institution clients in 2024 alone, including dozens of credit unions upgrading from aging systemsc. The appeal? Advanced automation, seamless core integration, and behavioral analytics that optimize when and how to contact borrowers.

Many collections managers noted limitations in their old manual processes and sought more efficient, data-driven tech to improve results.

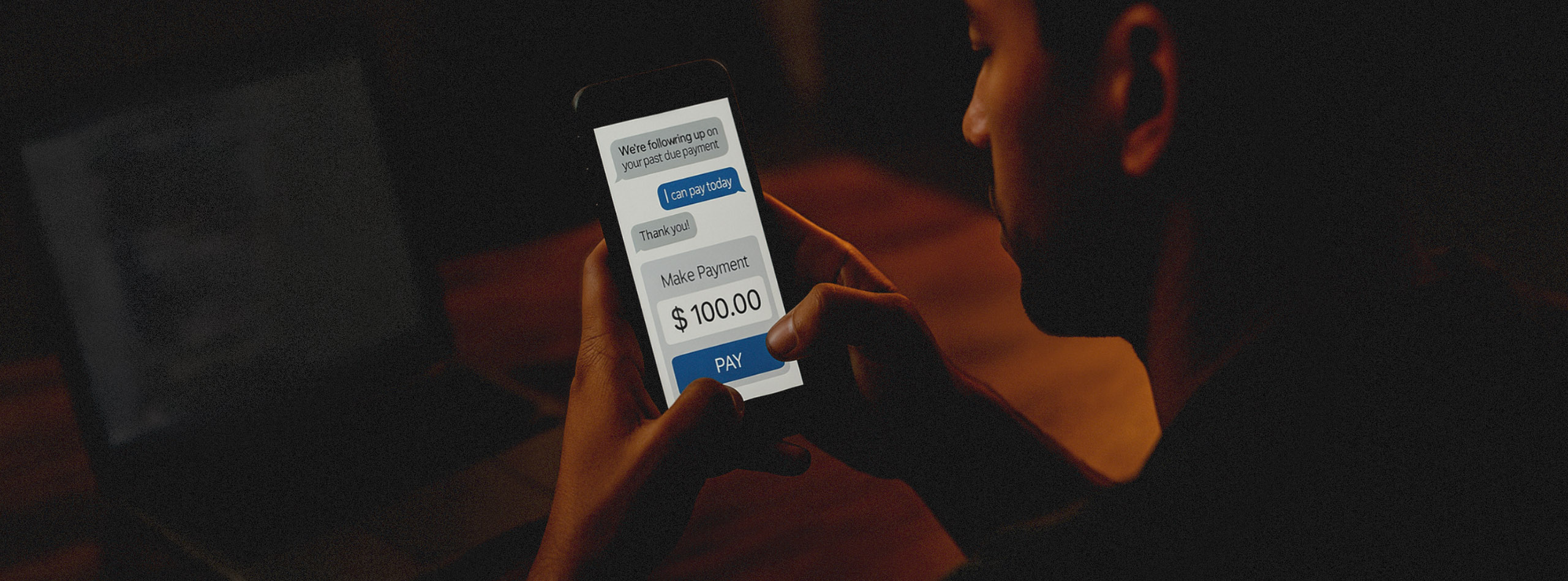

Likewise, firms like Eltropy – offering a unified texting and messaging platform – saw surging credit union interest. At year’s end, virtually every credit union over a certain size was leveraging SMS/text reminders, two-way secure chat, or even video calls to engage with past-due borrowers.

“Text messaging allows loan teams to connect proactively with members on their preferred channel, streamlining resolution for delinquencies,” said one fintech representative.

Indeed, members proved far more responsive to a friendly text than a cold-call. Some credit unions reported that digital outreach significantly improved cure rates on early-stage delinquencies, as borrowers found it easier to reply with a promise to pay or click a link to make an immediate payment. Automated workflows also freed up collectors to focus on the toughest cases.

Takeaway: 2024 saw collections go omnichannel. Credit unions that embraced automation and messaging are collecting more dollars faster, all while providing a smoother, less confrontational experience for members.